PricePoint

Разработчик University of Nebraska at Omaha College of Information Science and Technology

One of the most important and elusive issues confronting businesses is: What price should be charged for a product (or service) to maximize profits?

Pricing is a central element of business and marketing strategies. The limited discussion given to pricing in texts is because the quantification of the relationships between prices and profits has been, for all practical purposes, impossible. Theoretically, the relationship is known - the difficulty has been employing theory with actual operating data.

PricePoint is premised upon the microeconomics concept that profits are maximized where marginal revenue and marginal costs are equal.

The great advantages of PricePoint are its simplicity and the robustness of the results.

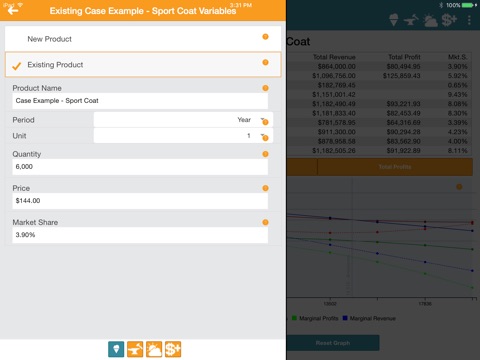

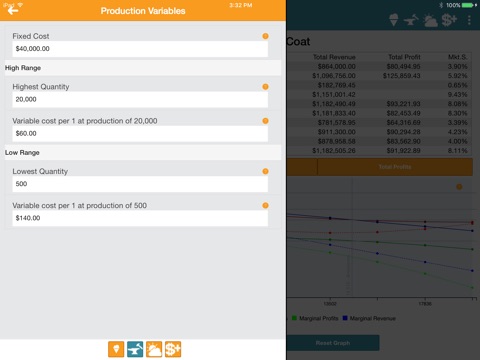

In addition to the quantitative results, PricePoint provides graphic representations of the cost and demand curves, including average profits and marginal profits.

There are many situations disclosed over more than 20 years of using the model:

•Maximum profit price is usually neither the highest price nor the lowest price among the alternative pricing strategies.

•A corporate strategy that is structured to attain maximum total revenue (gross sales) usually results in profits that are not maximized.

•Some applications of PricePoint have shown that the price currently being used for a product very closely maximizes profits. PricePoint has been able to confirm that the company was pricing correctly to maximizing profits.

•By reducing the variable costs of a product, profits are increased if the price is also decreased. To many, this was heresy: "Why would I share lower costs with customers when these operating savings were the result of my efforts?" The model has illustrated repeatedly that reducing prices would increase profits where variable costs have been reduced.

•Changing the fixed costs does not change the price that maximizes profits. Only the level of profits is affected while the profit maximizing price remains unchanged. This has been known by calculus – PricePoint illustrates this in application.

•Some corporations use a "Cost Plus Percentage" policy in establishing prices as is the case with a Fortune 100 firm that prices using "Cost Plus 12%". Their explanation: "Cost Plus is simple and we dont have a mechanism (pricing model) to calculate profits accurately".

•Advertising departments are commanded to improve sales and, supposedly, in turn profits. Increasing advertising usually requires additional resources and costs and may actually generate no improvement in sales or profits.

•Breakeven usually occurs twice for a product. PricePoint illustrates both breakeven points, when they occur within the stated production range

•Increasing market share through pricing can be attained in the model only by decreasing prices. An increased target market share almost always does not maximize profits, unless by chance. In many cases, that target actually moves away from the point of maximizing profits

•Knowledge of costs, both fixed and variable, is critical to correct pricing. A firm selling $21 million annually asked for pricing guidance but had no costing system even though there were 15 major product lines. It was impossible to use PricePoint constructively.

•In a firm with multiple products, the incorrect allocation of overhead (fixed costs) among the products can materially affect pricing and profits. PricePoint provides a mechanism by which the effects on profits by assigning various level of overhead can be calculated.

•Knowing the market (customers) and their sensitivity to changes in price levels is essential to correct pricing. The employees who work with customers daily know best what the customer responses will be. While the quantification of these demand responses is intuitive, the demand response values have proven to be reflective of actual demand conditions.

The critical question for business owners and executives is, "If you are not using PricePoint for pricing, what are you using?"